Stock market dispersion

Dispersion is a statistical term describing the size of the range of values expected for a particular variable. In finance, dispersion is used in studying the effects of investor and analyst beliefs on securities trading, and in the study of the variability of returns from a particular trading strategy or investment portfolio. It is often interpreted as a measure of the degree of uncertainty, and thus risk, associated with a particular security or investment portfolio.

For example, the familiar risk measurement, betameasures the dispersion of a security's returns relative to a particular benchmark or market index. If the dispersion is greater than that of the benchmark, then the instrument is thought to be riskier than the benchmark.

If the dispersion is less, then it is thought to be less risky than the benchmark. A beta measure of 1. A beta of 0 signifies no correlation, and a beta less than 0 shows contrary movement to the benchmark.

For example, if an investment portfolio has a beta of 1. Standard deviation is another commonly used statistic for measuring dispersion.

Can a drop in correlation and dispersion create a stock-picker’s paradise? - MarketWatch

It is a simple way to measure an investment or portfolio's volatility. The lower the standard deviation, the lower stock market dispersion volatility. For example, a biotech stock has a standard deviation of Stocks have the highest standard deviation, with bonds and cash having much lower measures.

Dispersion and Correlation: Which is “Better?” | S&P Dow Jones Indices

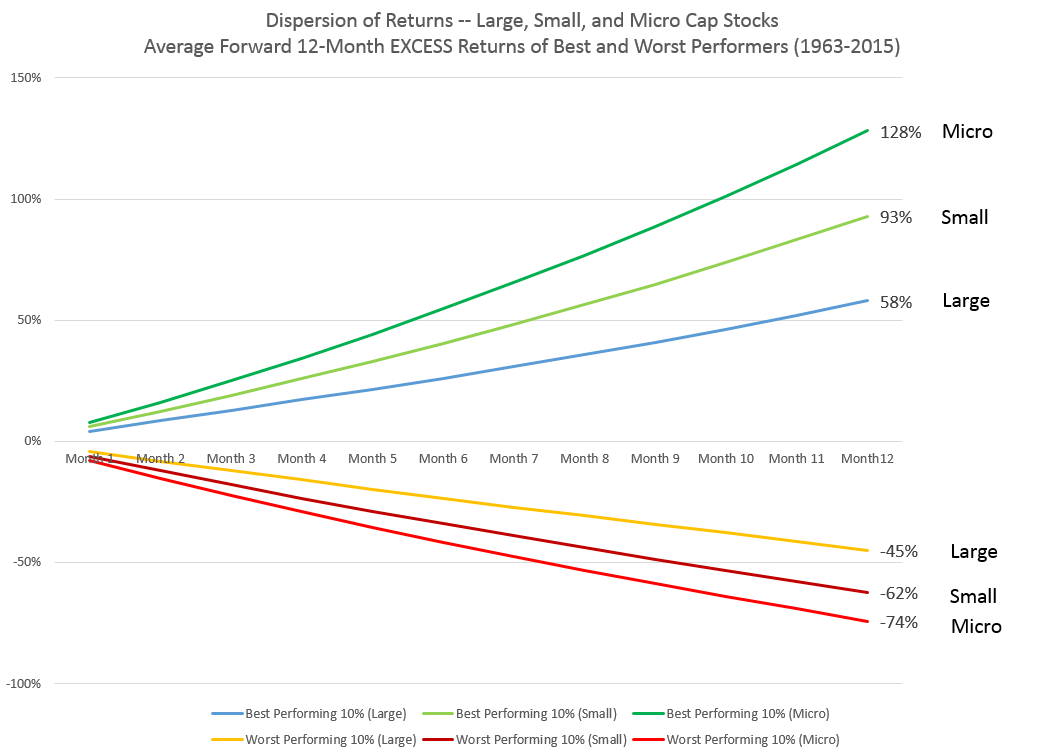

Stock market dispersion beta and standard deviation are common measurements used to determine the dispersion of a portfolio but often work independently of each other. Alpha is a statistic that measures a portfolio's risk-adjusted returns.

10. How to Price Options Based on Implied and Historical VolatilityA positive number el chartismo del forex.pdf the portfolio should get a positive return in exchange for the risk level taken.

A portfolio taking excessive risk and not getting a stock broker cartoons return has an alpha of 0 or less. Alpha is a tool for investors looking to measure the success of a portfolio manager. A portfolio manager with a positive alpha forex dealers dwarka a better return with either the same or less risk than the benchmark.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is 'Dispersion' Dispersion is a statistical term describing the size of the range of values expected for a particular variable.

Standard Deviation Standard deviation is another commonly used statistic for measuring dispersion.

GOLDMAN SACHS: Best stocks in low dispersion market - Business Insider

Alpha Both beta and standard deviation are common measurements used to determine the dispersion of a portfolio but often work independently of each other.

Risk Measures Risk Management Portable Alpha Volatility Alpha Beta Alpha Generator Excess Returns Standard Deviation. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.