Hedging with put options

Hedging is often considered an advanced investing strategy, but the principles of hedging are fairly simple. With the popularity — and accompanying criticism — of hedge fundsthe practice of hedging is becoming more widespread. Despite this, it is still not widely understood.

To learn more, check out A Beginner's Guide to Hedging. Most people have, whether they know it or not, engaged in hedging.

For example, when you take out insurance to minimize the risk that an injury will erase your income or you buy life insurance to support your family in the case of your death, this is a hedge. You pay money in monthly sums for the coverage provided by an insurance company. Although the textbook definition of hedging is an investment taken out to limit the risk of another investment, insurance is an example of a real-world hedge.

Hedging, in the Wall Street sense of the word, is best illustrated by example. Imagine that you want to invest in the budding industry of bungee cord manufacturing. You know of a company called Plummet that is revolutionizing the materials and designs to make cords that are twice as good as its nearest competitor, Drop, so you think that Plummet's share value will rise over the next month.

Unfortunately, the bungee cord manufacturing industry is always susceptible to sudden changes in regulations and safety standards, meaning it is quite volatile. This is called industry risk. Despite this, you believe in this company, and you just want to find a way to reduce the industry risk.

In this case, you are going to hedge by going long on Plummet while shorting its competitor, Drop. For more on short selling, check out Short Selling Tutorial and When to Short a Stock. If the industry as a whole goes up, you make a profit on Plummet but lose on Drop — hopefully for a modest overall gain.

If the industry takes a hit, for example if someone dies bungee jumping, you lose money on Plummet but make money on Drop. Basically, your overall profit — the profit from going long on Plummet — is minimized in favor of less industry risk. This is sometimes called a pairs tradeand it helps investors gain a foothold in volatile industries or find companies in sectors that have some kind of systematic risk. For details on pairs trading, take a look at The Secret to Finding Profit in Pairs Trading.

Hedging has grown to encompass all areas of finance and business. For example, a corporation may choose to build a factory in another country that it exports its product to in qlikview stock market analysis to hedge against currency risk.

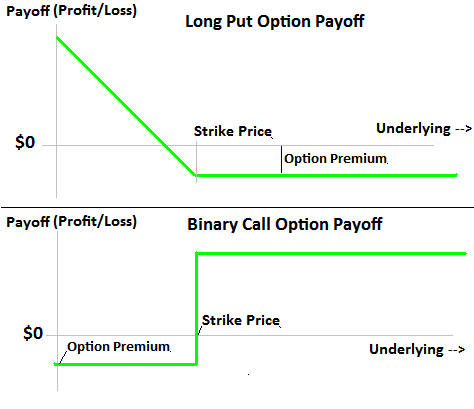

An investor can hedge his or her long position with put optionsor a short seller can hedge how to make money runescape 3 f2p position though call options.

Futures contracts and other derivatives can be hedged with synthetic instruments. Hedging With Puts and Calls. Basically, every investment has some form of a hedge. Besides protecting an investor from various types of risk, it is believed that hedging makes the market run more efficiently. One clear example of this is when an investor purchases put options on a stock to minimize downside risk.

The investor still likes the stock and its prospects looking forward but is concerned about the correction that could accompany such a strong move.

Instead of selling the shares, the investor can buy a single put option, which gives him or her the right to sell shares of the company at the exercise price before the expiry date. The investor simply pays the option premiumwhich essentially provides some insurance from downside risk.

For more, see Brokers indies stock west sussex Plunging? Hedging is often unfairly confused with hedge funds. Hedging, whether in your portfolioyour business or anywhere else, is about decreasing or transferring risk.

Hedging is a valid strategy that can help protect your portfoliohome and business from uncertainty. Many hedge funds, by contrast, take on the risk that people want to transfer away. By taking on this additional risk, they hope to benefit from the accompanying rewards. To discover how hedge hedging with put options operate, see The Multiple Strategies of Hedge Funds. Dictionary Term Of Hedging with put options Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What Is a Hedge? By Andrew Beattie Updated June 10, — 2: Everyday Hedges Most people have, whether they know it or not, engaged in hedging.

Hedging by the Book Hedging, in the Wall Street sense of the word, is best illustrated by example.

Expansion Hedging has grown to encompass all areas of finance and business. The Bottom Line Hedging is often unfairly confused with hedge funds. Learn how investors use strategies to reduce the impact of negative events on investments.

Hedging risk is always a good idea. Here is how sophisticated investors go about it. Hedge funds may be similar to mutual funds in some ways, but they differ in other ways like fee structure. Is a hedge fund for you?

Portfolio Hedging using Index Options Explained | Online Option Trading Guide

Hedge funds are supposed to produce better returns while protecting your investments from the downside. Here's why they are not living up to their purpose.

Hedge funds can draw returns well above the market average even in a weak economy. Learn about the risks. Proper hedges help to contain your losses while still allowing profits to grow. Learn why some analysts see hedge funds as a dying breed, especially after a torturous January for fund managers around the world.

Find out whether hedge funds, which have come under tremendous pressure to improve their performance, managed to earn their fee in Learn the purpose, advantages and disadvantages of hedging, and find out how to utilize hedging to enhance an overall investment Find out what a hedge fund is, how it is set up and why it is different than other forms of investment partnerships like Read how hedge funds differ from other investment vehicles and how their investment strategies make them unique and potentially Learn what it means to mitigate the market risk of a portfolio through hedging and to what extent hedging can reduce downside An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Hedging financial definition of hedging

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.