Optionsxpress autotrade

Follow Terry's Tips on Twitter.

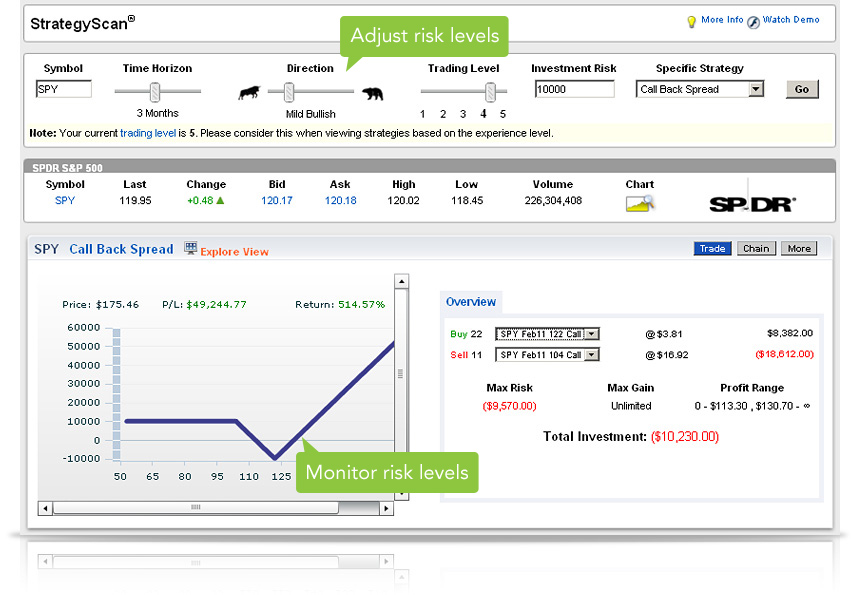

Auto-Trade Your Account

Like Terry's Tips on Facebook. Watch Terry's Tips on YouTube.

These rates will apply to all of your option trades at thinkorswim , not just those where you might be following our trade alerts. Case Study of a PEA Play Salesforce. In the week preceding the earnings announcement, several articles were published on Seeking Alpha that panned Salesforce. A sample, with a quote from each: Something Is Seriously Wrong With Salesforce. Most of the sales occurred in late December, , however, and I concluded that it was largely due to efforts to avoid the capital gains tax increase that was expected to come about in In opposition to all this negativity about the company, we saw indications that the stock might not fall after earnings as so many other companies have done.

For those reasons, when we placed the positions in place, we allowed for more room on the upside than on the downside. Here are the trades we placed: February 28, Trade Alert — Earnings Eagle Portfolio — LIMIT ORDERS. Note that the largest numbers of contracts were placed at the upper and lower extreme strike prices, and no spreads at all were at the at-the-money strike.

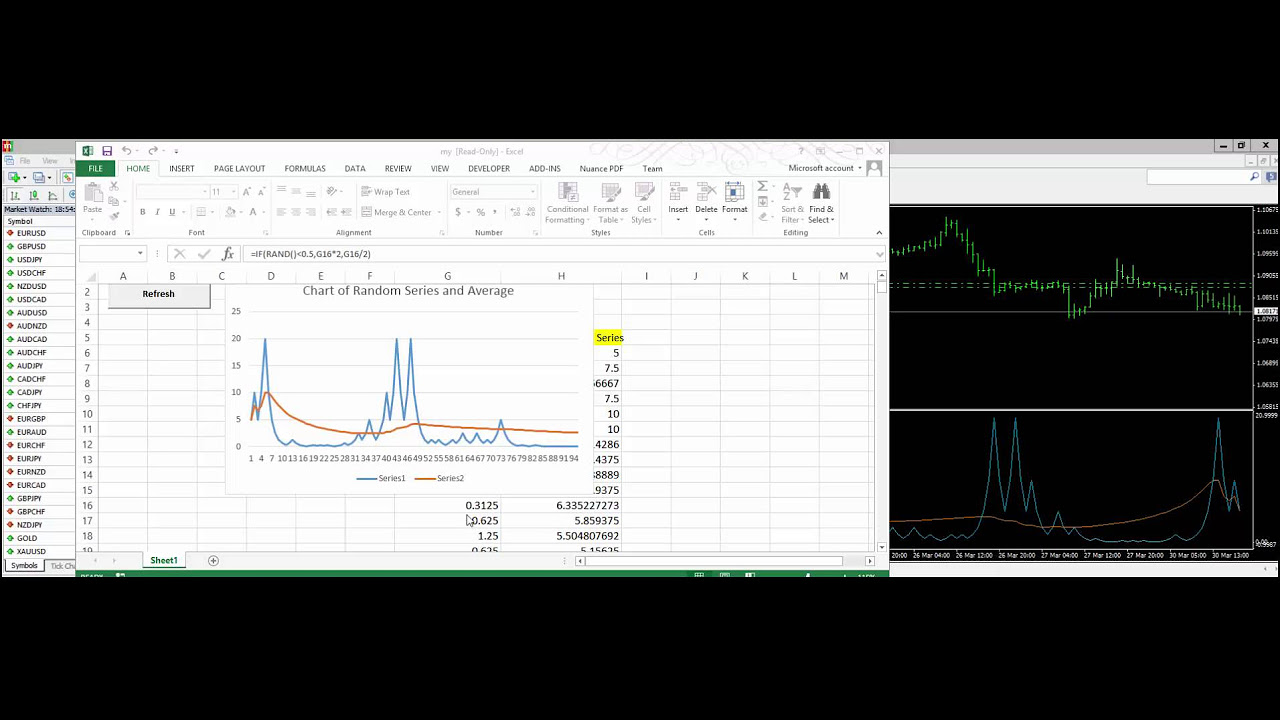

These choices resulted in a relatively flat risk profile graph curve with a little more coverage on the upside than the downside. There was a huge implied volatility IV advantage to our calendar spreads. IV for the Mar weekly options was compared to 36 for the Apr options. The big question was how much the April options would fall in value once earnings were announced. We estimated that IV would fall by 5, to 31 after the announcement.

With this assumption, the risk profile graph looked like this: What happened, however, was that IV of the April options fell all the way to 27, reducing the amount that we were able to gain on the trades.

Here are the trade alerts that we issued and the prices we got for the spreads:. This entire amount was really not at risk because the long April options would always have a greater value than the Mar weekly options that we had sold, and we were planning on exiting all the trades on Friday, March 1 so there would be no further decay in our long options. We lost money on three of the six spreads we bought but the gain on the other three spreads was much greater than our losses on the losers.

We continue to learn.

optionsXpress | Frequently Asked Questions: Xecute

First, we underestimated how much IV falls after the announcement. Second, our idea that stock fundamentals are not as important as expectations in PEA Play s was reinforced and historical results after earnings is also important. Third, taking off the spreads furthest away from the stock price early is the best way to go all these spreads ended the day well below what we sold them for.

OptionsXpress Drops Auto-Trade | Terry's Tips Stock Options Trading Blog

Auto-Trade , Calendar Spreads , Calls , Credit Spreads , CRM , diagonal spreads , Earnings Announcement , Earnings Option Strategy , Earnings Play , implied volatility , Profit , profits , Puts , Stocks vs. Stock Options , Terry's Tips , thinkorswim , VIX , Volatility. This entry was posted on Monday, March 4th, at 2: This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways and sometimes the woods. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website.

Options are not suitable for all investors as the special risks inherent to options trading my expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options.

Vermont website design, graphic design, and web hosting provided by Vermont Design Works.

Even More Pre-Earnings-Announcement Plays Case Study of a PEA Play Salesforce. Here are the trade alerts that we issued and the prices we got for the spreads: Stock Options , Terry's Tips , thinkorswim , VIX , Volatility This entry was posted on Monday, March 4th, at 2: Search Blog Search for: Stock Options Straddles Strangles Terry's Tips thinkorswim VIX Volatility VXX Weekly Options Weekly vs.

Monthly Options William Tell. Success Stories I have been trading the equity markets with many different strategies for over 40 years.