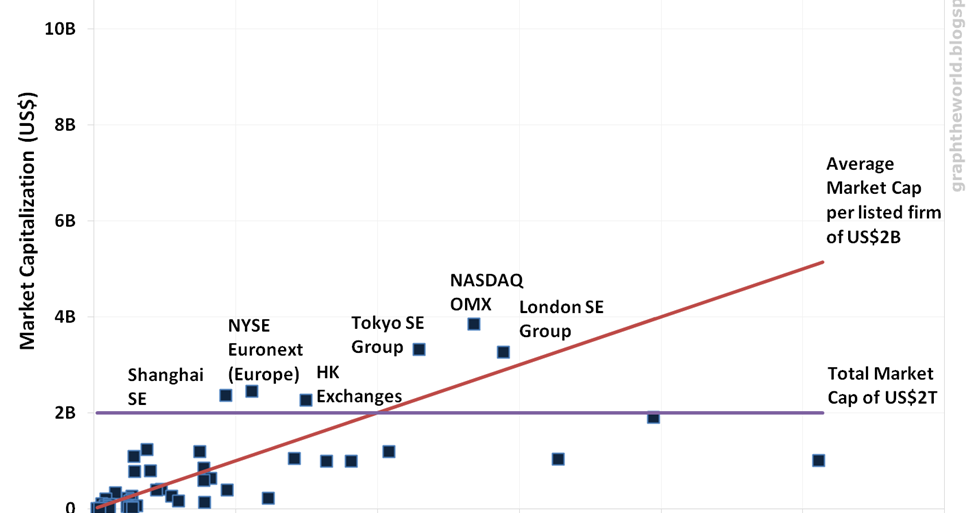

Market cap of stocks on nyse euronext

You will be given information that your mind will use to create a more accurate picture of the financial markets in relation to successful penny stock investing. The topics included under this section are a follows:. I am not covering the OTC Market in detail in this Section. The OTC Market is also part of the US Stock Market, but none of the OTC markets are stock exchanges.

I have chosen this path because the OTC market is used by Extraordinary Investors to predominantly research developmental technology stocks and also exploration stocks.

NYSE: Listings Directory - Stocks

So, unlisted stocks, including the Toronto Stock Exchange are covered under that topic - Technology Stocks. What is a Stock Market? In general, the Stock Market also known as an Equity Market consists of shares of many different stocks - listed and unlisted.

Paris Stock Exchange History & Trading Holidays

The stock market is basically a place where investors and traders are able to trade shares of publicly held companies that are either:. Publicly held companies are those companies owned by the public by means of shares of the company's stock. Stock markets in different countries are regulated by commissions. In this entire sectionyou will be learning what you need to know about the stock market as a means of trading penny stocks successfully.

This is basic essential information that you must know to trade penny stocks. This behind the scenes knowledge helps your mind understand how stocks operate so you may better determine the success or failure of a potential stock investment.

By understanding how stocks are regulated and traded within various financial markets in the Stock Market, you learn some important things about a stock you are screening and watching. For instanceyou are more likely to become aware of, and alert to, future events that may cause a stock you are watching to be delisted from an exchange - which is generally not good.

You will learn other important things about the financial markets as you read on that will help you understand risks and prevent you from being defeated for lack of knowledge. Please do not skip this topic or any of the subtopics. The lessons are fairly short. Really you are nearing completion of your study of this free site, so please do not be impatient.

Two primary financial markets within the stock market are as follows: The following are brief descriptions of 1 Stock Exchange and 2 Over-The-Counter OTC:. A Stock Exchange represents that part of the stock market operating as any SEC approved and regulated stock exchange.

The NYSE, NASDAQ, NYSE MKT aka AMEXthe ECN's called BATS, Direct Edge and EDGA, and all regional stock exchanges are SEC approved stock exchanges.

A stock exchange use to include any facilities constructed for the purpose of trading stocks. That is no longer the case. For instance, the NASDAQ does not exchange securities within a facility, but rather all trading is accomplished through broker-dealer networks in which thousands broker-dealers market makers communicate all trading through their own computers in many locations.

These broker-dealer networks bring traders together from all over the country and even the world to trade securities. In the USAthe stock exchange is overseen and authorized by the Securities and Exchange Commission SEC. A similar council governs each foreign stock exchange.

Although some ECN's are stock exchanges, such exchanges exist to trade securities that originate from other financial markets. I will give more detail about the NYSE, AMEX, NASDAQ, the ECN's and Regional Stock Exchanges in later subtopics under this topic with a focus on nano-cap stocks.

Each stock exchange except for ECN stock exchanges in the stock market has a commission or review board exchange karachi pakistan stock trade screen and kse live rates is unique to that specific exchange it represents.

These review boards govern and enforce regulations for companies to be listed and remain listed on that exchange, or even to be delisted from that exchange. The OTC represents OTC BB, Pink Sheets, Grey Sheets.

The OTC BB and Pink Sheets stocks are traded like stocks on the stock exchanges by the retail trader or investor. Big money maker fundraisers the scenes, OTC BB and Pinks Sheets stocks are traded much like NASDAQ stocks in that all shares are traded between private parties broker-dealers by means of a dealer network electronically or by phone.

The broker-dealers themselves are called Market Makers. OTC financial markets do not operate within a facility constructed for the purpose of trading, nor are they approved as stock exchanges by SEC; so, they are not part of the Stock Exchange. A dealer network, just as with the NASDAQ, is composed of broker-dealers Market Makers who buy up a bulk number of shares of one or more companies.

These broker-dealers then buy and sell directly with one another over computer networks and by phone by means of a quotation service. These broker-dealer networks also compete for trading activity to the general public just as any stock on the NASDAQ.

Since all shares of a stock are traded through Market Makers of each stock, the Market Makers set quote prices. As noted previously, the OTC BB and Pink Sheets operate almost exactly like the NASDAQ in the trading of shares of stock using an online broker. The shares of OTC stock are referred to as "unlisted. The Over-the-Counter market consists of the following types of stocks or financial markets: I will explain each of these types OTC markets in more detail under the section called "Technology Stocks.

Recap of what we have learned about trading OTC stocks. Trading penny stocks on the stock exchanges or the OTC is very similar outwardly and quite easy to do, at least for the OTC BB and the better Fortune teller stock market Sheet stocks.

Even though the OTC market is not a SEC approved stock exchange, like the US Stock Exchange, most times shares are, outwardly, traded bought or sold the same way by most traders and investors. Short selling of most OTC stocks is legally permissible but may be restricted in some way by your broker - especially for pinksheet stocks. The main reason for restrictions on shorting OTC stocks has to do with risks associated with low liquidity - low volume of trading coupled with a low market cap.

As an Extraordinary Investor, do not be concerned about short selling of penny stocks.

How to Calculate Market CapitalizationConcentrate your efforts on buying and selling shares of penny stocks using the proven investment strategies you forex yahoo chart studying on this site. Why no short selling?

You want to avoid the risks associated with short selling thinly traded market cap of stocks on nyse euronext. As well, you will have enough on your plate just buying and selling penny stocks; so, that is where you must specialize to minimize risks and maximize profits.

As you become more experienced, short selling NASDAQ penny stocks is not that risky if done at the end of a major explosive bull trend. Predicting the top of best way to make money on eve explosive trends is fairly easy for penny stocks; so, shorting at the top is fairly safe. You will not do cancer registrars work from home to short stocks to make good money trading penny stocks though.

We generally consider the safest penny stocks to trade on the stock market to be those stocks listed on the Stock Exchange - especially the NYSE and the NASDAQ. Generally thoughthe greater safety and volume of these types of penny stocks translates into:.

This all translates into "generally" far less profitable trades then those stocks traded on the OTC-BB. I say "generally" because a number of sleeper penny stocks OTC type stocks do trade on the NASDAQ.

A good marketeer promotion can actually create terrific trading activity for the stock by attracting NASDAQ stock traders - which are many in comparison to OTC stock traders. Risks associated with the OTC are easily overcome by the Extraordinary Investor. This site has already revealed to you the reasons and ways how the Extraordinary Investor takes advantage of the risks others take - mainly by screening, locating, studying and investing in those sleeper penny stocks with the greatest potential to be promoted by marketeers.

Solid in-depth fundamental analysis and basic technical analysis is essential for locating those thinly traded stocks anywhere in the stock market with the greatest possible trading success. These are the penny stocks that marketeers most desire to promote. The Extraordinary Investor will already have purchased his shares first in such stocks, which is why such investor gains the advantage from the risks others take - those who jump in after the stock begins its explosive trend up.

This will all be explained to you again, and in more depth as you continue your journey through this site. This page is just the beginning of you lessons on the Stock Market - The Essentials for Successful Penny Stock Investing. Next Lesson is on the Penny Stock Market. This market exists everywhere within the Stock Market and is where you will be specializing to earn enormous low risk profits as an extraordinary investor. When You are ready Stock Market The Essentials for Successful Penny Stock Investing This is a new section called: The Essentials for successful penny stock investing" You will be given information that your mind will use to create a more accurate picture of the financial markets in relation to successful penny stock investing.

The topics included under this section are a follows: I do cover the OTC market in fair depth under a future section called: The stock market is basically a place where investors and traders are able to trade shares of publicly held companies that are either: These are called "unlisted" stocks.

Why is this knowledge important? The definition of a stock exchange A stock exchange use to include any facilities constructed for the purpose of trading stocks.

NYSE Euronext - Wikipedia

The USA stock exchange consists of: Commissions and Review Boards insure safer trading Each stock exchange except for ECN stock exchanges in the stock market has a commission or review board that is unique to that specific exchange it represents.

Dealer Market and OTC A dealer network, just as with the NASDAQ, is composed of broker-dealers Market Makers who buy up a bulk number of shares of one or more companies. The only real differences are: OTC are unlisted stocks The shares of OTC stock are referred to as "unlisted. Now I will continue with this lesson. Greater safety is inherent in these trading vehicles because of: Generally thoughthe greater safety and volume of these types of penny stocks translates into: Please pay it forward.

Home Trending Stocks Investor Advantage Stock Market Basics Disclaimer Technical Analysis Fundamental Analysis Pennystock Trading Risks Hot Stocks List Stock Market Real-Time Quotes Technology Stocks Pink Sheets Canadian Stocks TSX Venture Trading Penny Stock Trading Penny Stock Broker SiteMap.