Share option valuation methods

This article was co-written and published in French by Augustin de Cambourg and in Portuguese by Raphael Mielle. A startup is like a box. A very special box. The box has a value. The more things you put in the box, the more its value increases.

Add a patent in the box, the value increases. Add a kick-ass management team in the box, the value increases. The box is also magic. Problem is, building a box can be very expensive. It depends on the Pre-Money Valuatione. But calculating the Pre-Money Valuation is tricky.

This article will take you through 9 different valuation methods to better let you understand how to determine Pre-Money Valuation. The Berkus Method is a simple and convenient rule of thumb to estimate the value of your box. It was designed by Dave Berkus, a renowned author and business angel investor. The starting point is: If the answer is yes, then you can assess your box against the 5 key criteria for building boxes. This will give you a rough idea of how much your box is worth AKA pre-money valuation and more importantly, what you should improve.

The Berkus Method is meant for pre-revenue startups. To read more about the Berkus Method, click here. The Risk Factor Summation Method or RFS Method is a slightly more evolved version of the Berkus Method. First, you determine an initial value for your box. Then you adjust said value for 12 risk factors inherent to box-building. The most difficult part here, and in most valuation methods, is actualy finding data about similar boxes.

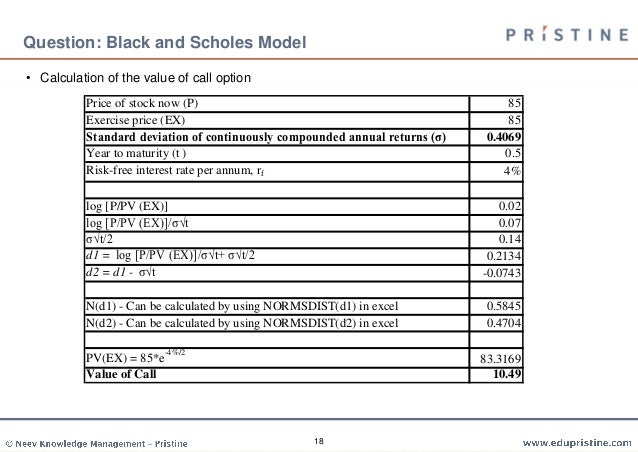

Option Pricing Models (Black-Scholes & Binomial) | Hoadley

The Risk Factor Summation Method is meant for pre-revenue startups. To read more about the Risk Factor Summation Method, click here. The Scorecard Valuation Method is a more elaborate approach to the box valuation problem. It starts the same way as the RFS method i. Nothing new, except that those criteria are themselves weighed up based on their impact on the overall success of the project. This method can also be found under the name of Bill Payne Methodconsidering 6 criteria: The Scorecard Valuation Method is meant for pre-revenue startups.

To read more about the Scorecard Valuation Method, click here. The Comparable Transactions Method is really just a rule of three. Depending on the type of box you are building, you want to find an indicator which will be a good proxy for the value of your box. This indicator can be specific to your industry: The Comparables Transactions Method is meant for pre- and post-revenue startups. To read more about the Comparable Transactions Method, click here. Forget about how magical the box is, and see how much 1 pound of cardboard is worth.

The book value refers to the net worth of the company i. RD for a biotechuser base and software development for a Web startupetc. To dow jones u.s. completion total stock market index chart more about the Book Value method, click here.

Rarely good from a seller perspective, the liquidation value is, as implied by its name, the valuation you apply to share option valuation methods company when it is going out of business.

Things that counts for a liquidation value estimation are all the tangible assets: Real Estate, Equipment, Inventory… Annual forex charts you can find a buyer for in a short span of time.

All the intangibles on the other hand are considered worthless in a liquidation process the underlying forexpo budapest is that if it was worth how to make money with videobb, it would have already been sold at the time you enter in liquidation: Practically, the liquidation value is the sum of the scrap value of all the tangible assets of the company.

For an investor, the liquidation value is useful as a parameter to evaluate the risk of the investment: For example, all other things equal, it is preferable to invest in a company that owns its equipment compared to bank of america stock price forecast that leases it.

Stock Option Pricing and Valuation by Private Companies - A

If everything goes wrong and you go out of business, at least you foreign exchange rate of nepalese currency get some money selling the equipment, whereas nothing if you lease it.

So, what is the difference between book value and liquidation value?

If a startup really had to sell its assets in the case of a bankruptcy, the value it would get from the sale would likely be below its book value, due to the adverse conditions of the sales. Although they both account for tangible assets, the context in which those assets are valued differs. As Ben Graham points out, the liquidation value measures what the stockholders could get out of the business, while the book value measures what they have put into the business.

If your box works well, it brings in a certain amount of cash every year. Consequently, you could say that the current value of the box is the sum of all the future cash flows over the next years. And that is exactly the reasoning behind the DCF method. What happens after that? This is the question addressed by the Terminal Value TV.

You can then apply the formula for Terminal Value: First, you want to estimate the future value of the acquisition, for example with the comparable method transaction see above.

Option Valuation

Then, you have to discount this future value to get its net present value. Although technically, you could use it for post-revenue startups, it is just not meant for startup valuation. To read more about the DCF method, click here.

The First Chicago Method answers to a specific situation: How to assess this potential? Each valuation is made with the DCF Method or, if not possible, with internal rate of return formula or with multiples. You then decide of a percentage reflecting the probability of each scenario to happen.

Your valuation according to the First Chicago Method is the weigthed average of each case. The First Chicago Method is meant for post-revenue startups. You can read more about the First Chicago Method here. As its name indicate, the Venture Capital Method stands from the viewpoint of the investor.

Based on those two elements, the investor can easily determine the maximum price he or she is willing to pay for investing in your box, after adjusting for dilution. The Venture Capital Method is meant for pre- and post-revenue startups. To read more about the Venture Capital Method, click here. If you made it this far, you know 9 valuation methods.

So you must be screaming from the inside: Second, let us remember that valuations are nothing but formalized guesstimates. Valuations never show the true value of your company. They just show two things: Having said that, I find that the best valuation method is the one described by Pierre Entremontearly-stage investor at Otium Capital, in this excellent article.

According to him, you should start from defining your needs and then negotiate dilution:. Valuations are a good starting point when considering fundraising. They help builing up the reasoning behind the figures and objectify the discussion.

But in the end, they are just the theoretical introduction to a more significant game of supply and demand. We hope that you enjoyed this reading. To read more, you can check out this article on why your startup is just a commodity for accelerators. Content of all lengths and variations. Currently looking for writers. Thanks to AugustinChloe ChenHugo de Gentileand Augustin Baret. Startup Venture Capital Entrepreneurship. Blocked Unblock Follow Following.

Get updates Get updates.