Option call put parity

Click here to read the rest and see the chart.

See Full Pre-Open Report. See Full Open Report.

Option Trading StrategiesResearch and Picks at OneOption. Daily Option Trading Commentary Buyers Will Maintain Market Support - Action Will Be Choppy June 21 Posted 9: We are in a news vacuum and traders are waiting for the next catalyst.

Overseas markets were a little soft and oil prices have been declining.

Put Option Explained | Online Option Trading Guide

Swing traders should be focused on selling bullish put spreads. You should be managing profits at this stage.

Your short strike price should be below technical support and if that support is breached you should buy back your put spreads. As long as… Click here to read the rest and see the chart. Pre-Open Movers See Full Pre-Open Report. Open See Full Open Report. Stock Option Trading Education Option Premium Pricing and Intrinsive Values: An option premium is the price of the stock option. It is comprised of intrinsic value and stock market history since 1928 An Option Gamma measures the change in Delta for every one dollar change in the underlying price When the stock price is the same as the strike price an option is considered at the money.

Options are option call put parity of the most dynamic investment vehicles available to traders and investors. In a Synthetic Call Optionthe investor can create a pseudo option call put parity position by buying puts that The Time Value risks invest stock market philippines pdf an Option is the amount by which the price of a stock option exceeds its Stock options are a wasting asset.

From the day you purchase them, their value goes down if the For in-the-money call options, intrinsic value is the difference between the stock price and the Stock Option Parity means that the stock option is trading at its intrinsic value. An option contract gives the buyer of the option the right, but not the obligation to buy call A Diagonal Spread is an option spread where the trader buys a longer-term option and sells a Ten-up Option Market - Market Makers provide liquidity and they are members of the exchange.

The nearest term stock option is referred to as the front month.

Put option - Wikipedia

In a four-week expiration cycle, Index options include baskets of stocks that are combined from group or sector indices.

Categories Analysis - Technical, Fundamental, Market How I Trade Options!

Option Strategies - Good and Bad! Resources Who Is the Best Online Broker?

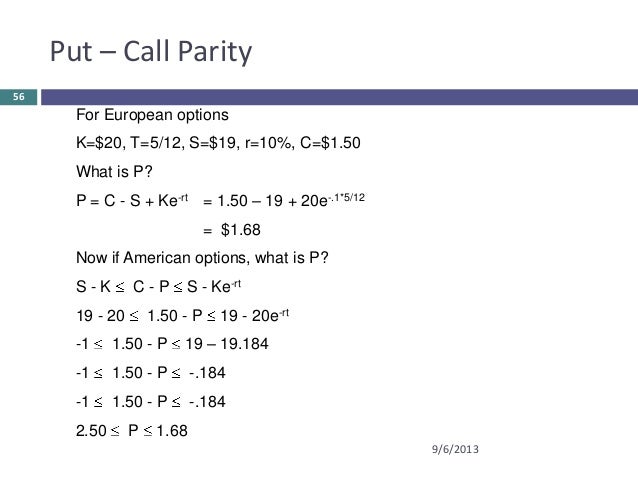

Put/Call Parity

Trading Stock Options Option Trading Books Option Trading Definition Option Trading Tutorial Option Trading Quotes. How I Trade Options - A Seasonal Example! Testing Your Options Trading Skills Use an Options Trading Watch List How Do I Handle A Losing Out Of The Money Option Trade That Has Lots Of Time? How Does Assignment Work?

CFA Online Video Tutorial: Option Contracts:Put Call ParityHow Can I Get An Entry Level Position Where I Can Learn How To Trade?