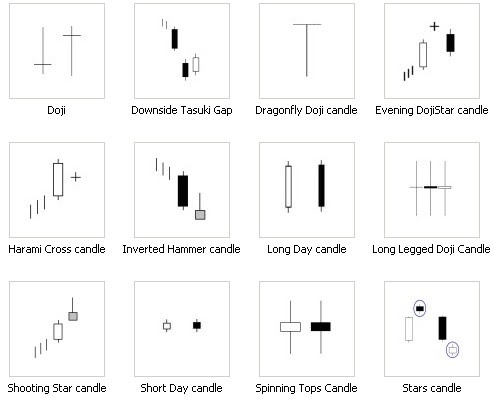

Candlestick patterns day trading

The shooting star is a single bearish candlestick pattern that is common in technical analysis. However, this also looks like an inverted hammer candle pattern. So, how can we distinguish the two? The answer to this question is hidden in the price direction before the creation of the candle.

If a stock is in a bullish uptrend and you identify a shooting star candle, then there is a solid chance that the trend will reverse. For this reason, traders use this candle to enter short trades on the assumption that the bullish move is running out of steam.

Once you are able to identify the shooting star, you should look to open a short position on a break of the low of the candle. The expectation for the profit potential for the shooting star is 3: The shooting star candlestick is considered one of the most reliable candlestick patterns. One of the reasons for this is the unique structure — a small body with a high upper candlewick.

First, buyers are enjoying their gains as the stock shoots to a short-term high. As this euphoric moment begins to set in, short traders begin to sell the stock on a flurry of buy orders. At this point, the longs who were late to the party begin to get scary and start to sell out as well. This panic long selling and short selling leads to a sharp reversal in the price actionthus generating a small candlestick body on the chart. It is important to mention that the shooting star candlestick pattern is even more reliable when it develops after three consecutive bullish candles.

This creates exponential bullish pressure on the chart. In such cases, the shooting star candle is likely to have an even bigger upper candlewick. This implies that the price is about to reverse with even bigger strength.

To do so, you will first need to identify an active bullish trend. Then you need to spot a candle with a small body and a big upper candlewick. When you identify a shooting star candle during a bullish trend, you will need to wait for another signal. You will also need a bearish candle to break the low point of the shooting star body.

This will confirm the validity of your shooting star on the chart.

Candlestick Patterns for Day Trading

If you are able to identify the presence of these signals, then you should short the security. After all, you are anticipating an upcoming bearish price move. You should always trading options dvd a stop loss order when trading the shooting star candle pattern. Therefore, we place a stop loss to contain a price loss equal to the size of the pattern. At the same time, our target is for a price move equal to three times the shooting star.

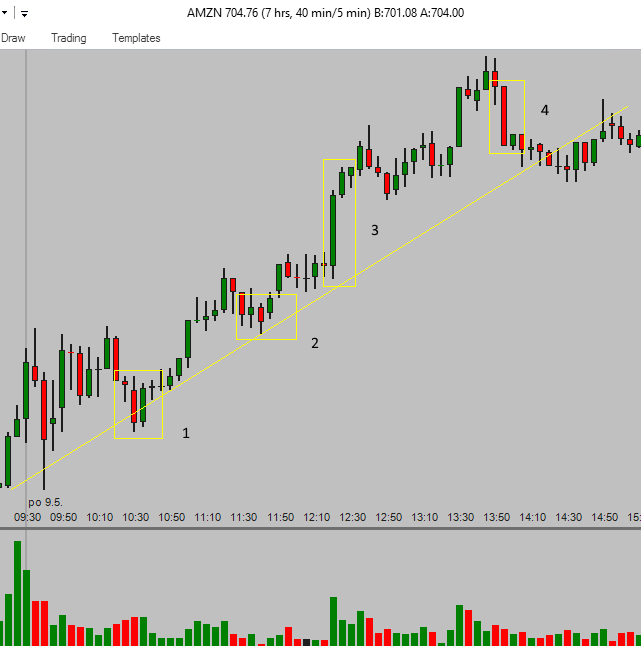

Now that we have the shooting star rules in front of us, we will combine these three basic steps into a trading strategy. This candlestick patterns day trading the 2-minute chart of Hewlett-Packard from June 10, The image illustrates a classical shooting star trading example. Suddenly, a shooting star candlestick appears, which is marked with the green circle on the chart.

We have a small candle body and a big upper candlewick, which confirms the shape of the pattern. Therefore, we sell the security netbanking hdfc forex plus cards the pattern confirmation.

At the same time, we place a stop loss order above the upper wick of the shooting star candle in order to secure our short trade. Now, if the price creates an unexpected bullish move caused by high value stock options ipo, we will be protected.

Our maximum loss will be equal to the distance between the level we short HPQ and the level of the stop loss order. The forex broker in hyderabad blue arrow on the image measures the size of the candlestick.

According to our shooting star trading strategy, we should seek a target equal to three times the size of the pattern. Thus, we apply the size of the pattern three times starting from the lower candle wick. This is how we get the big blue arrow, which points out the minimum target of our trading strategy.

Now we need to stay in the trade until the price action closes a candle beyond the minimum target. The price reverses after we short Hewlett-Packard. On the way down, the price creates one correction during the bearish move.

Day Trading technical analysis - candlestick chart course

The downward activity then resumes and 18 periods after we short HPQ, the price action closes a candle below the minimum target of the pattern. Luckily, this candle is relatively big and goes way beyond the minimum target. As you see, the shooting star candle pattern gives us an indication that the trend might reverse. This creates a nice premise to short HP right in the beginning of an emerging bearish trend. Despite the correction on the way down, the shooting star reaches the target of three times the size of the candlestick.

The chart starts with a price increase — Apple creates higher highs and higher lows. On the way up, the price action completes a shooting star candlestick pattern on the chart. You can see the figure in the green circle on the image. Now we have a reason to believe that the price action could be reversed.

We wait to see if the next candle is going to confirm the authenticity of the shooting star reversal pattern. Fortunately, the next candle is bearish and breaks the low of our shooting star candle on the chart. This gives us a strong bearish signal and we short Apple at the end of the bearish candle.

Best 5 Forex Candlestick Patterns for Day Trading - ForexBoat Trading Academy

At the same time, we place a stop loss order at the highest point of the shooting star — above the upper candlewick. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. After we short Apple, the price enters a downtrend. The range is then broken and the price action creates a new bearish impulse on the chart. This impulse leads the price to complete a total bearish move of three times the size of the shooting star pattern.

This is the minimum target for our trade and we close the position. This is another short deal caused by the shooting star trading candle. As you see, the minimum target of the pattern is completed after a short hesitation by Apple. Learn to Day Trade 7x Faster Than Everyone Else Learn How.

Candlestick Patterns | Top 10 Best Patterns For Traders

Free Trial Log In. How to Day Trade the Shooting Star Candlestick Pattern. How to Change the Background Color.

How to use the Coppock Curve with other Indicators. Day Trading Setups — 6 Classic Formations. How to Trade the Dead Cat Bounce. Simple Strategy for Trading Gap Pullbacks. Categories Candlesticks Chart Patterns Day Trading Basics Day Trading Indicators Day Trading Psychology Day Trading Software Day Trading Strategies Day Trading Videos Futures Glossary Infographics Investment Articles Swing Trading Trading Strategies.

Customer Login Sign Up Contact Us. Login Sign Up Contact Us.