Put call parity american options dividend

This action might not be possible to undo. Are you sure you want to continue? BROWSE BY CONTENT TYPE Books. Upload Sign in Join Options. Join Sign In Upload. Share or Embed Document. Flag for inappropriate content. David Weinbaum Put-Call Parity and Stock Returns.

Documents About Option Finance. Pershing Square IV Letter to Investors. Solution provided by Assignment helper zone Tutor. Ya Ram Final Notes 1 and 2 Units Foe 1 Unit Test Ya. Notes - Option Payoffs. Models behaving badly Book Notes.

Documents About Option Finance Skip carousel. Letter to Investors 9. ACCA Exam Tips June OpenTuition. Hedge Fund Gates Study.

Markopolos Testimony on Madoff. Lease with Option to Purchase. Blount and Dolly H. Commissioner of Internal Revenue, F.

Put-call parity clarification (video) | Khan Academy

Seversky Electronatom Corporation, F. El Paso Natural Gas Company, Cross-Appellee v. Western Building Associates, a Partnership R. Interstate Securities Corporation, Plaintiff-Counterclaim v. Okumus, Okumus Capital, Llc, Okumus Opportunity Fund, Ltd. P 97, 5 Fed. Divine and Rita K. PIONEER NATURAL RESOURCES CO 8-K Events or Changes Between Quarterly Reports In the Matter of Fashion Optical, Ltd.

Joe Steele, Trustee v. Commitment of Traders Report. T4 B8 Hence Fdr- Entire Contents- Kyle Hence Email Fwd by Zelikow to Team 4 and Copy of Making a Killing- Part II Documents About Arbitrage Skip carousel. Check Register FY Woodlands RUD. The Fed is a Crappy Reinsurer IV. Order Against Carlson Capital. UT Dallas Syllabus for fin FreddieandFannieValue Investing Congress West Kao VIL. Did Enron Pillage California? International Journal of Business and Economics. Option Put-Call Parity Relations When the Underlying Security Pays Dividends.

Department of Finance, University of Miami, U. The original put-call parity relations hold under the premise that the underlying security does not pay dividends before the expiration of the options. Similar to Hullthis paper relaxes the non-dividend-paying assumption.

Forbidden

The upper bound of the American-style put-call parity relation is adjusted upwards by the amount of the present value of expected dividends. The results provide theoretical boundaries of options prices and expand application of put-call parity relations to all options on currencies and dividend-paying stocks and stock indices, both European-style and American-style.

The option put-call parity condition quantifies the relations among the price of a call option, the price of an otherwise identical put option, the price put call parity american options dividend the underlying security of the call and put options, and the present value of the exercise price of the call and put options. The parity relations can be applied to both Put call parity american options dividend and American-style options. Put-call parity relations for standard Europ ean-style and American-style options have been well accepted by the finance profession.

Early studies in options, e. Received February 20,revised December 25,accepted March 8, Department of Buy bankrupt stock uk, University of Miami, P. BoxCoral Gables, FL The original put-call parity relations are derived under the premise that the underlying security does not pay dividends before the expiration of the options.

However, a large number of stocks and almost all stock indices pay dividends. Furthermore, all foreign currencies bear foreign risk-free rates. The foreign risk-free rates of interest can be viewed as dividends mssb stock options leakages paid on the foreign currencies.

Consequently, the non-dividend-paying assumption severely restricts the usage of the original put-call parity relations. The original put-call parity relations may not be applied to these heavily traded options on dividend-paying securities. Similar to Hullthis paper relaxes the non-dividend-paying assumption on the underlying security.

It presents a variation of the relations when the underlying securities pay dividends. This paper shows the theoretical boundary conditions to call and put option prices when the underlying security pays dividends.

It is particularly important to option traders who trade American-style options on stocks and stock indices e. Inherited in the put-call parity relation, another important property of our results is that they are purely arbitrage-driven and totally model-free. The results are independent of any particular option pricing models, e. The best free money poker sites assumption needed for the conclusions to hold is that the financial markets are efficient, which is widely believed to be true.

This paper is organized as follows. The next section derives cirencester livestock market driffield proves the put-call parity relation for European-style options.

The third section deals with the put-call parity relation for American-style options. The final section concludes. Put-Call Parity for European-Style Options.

If the underlying security does not pay dividends before the option expires, the original put-call parity relation for European-style options can be given by the following simple equation: Tie Su and Weiyu Guo.

Proof of the above relation can be found in most textbooks on options.

If the underlying security pays a dividend or dividends before the options expire, the put-call parity relation can be modified as: For example, if the underlying security is expected to pay a dividend. The proof of the dividend-adjusted put-call parity for European-style options is straightforward. For simplicity and without loss of generality, assume there is only one cash dividend payment.

We tre at con tin uou s div ide nd yie lds at the end of the nex t sec tio n. Consider that an investor holds the following two portfolios from today until the options expire: Note that the first portfolio contains a share of an underlying security that pays dividend.

The terminal value of the first portfolio at time. This occurs because if. Because the two portfolios always have the same terminal value, they must have exactly the same present value in an efficient market. Consequently, we must have. The put-call parity relation for European-style options is thus proved.

Put–call parity - Wikipedia

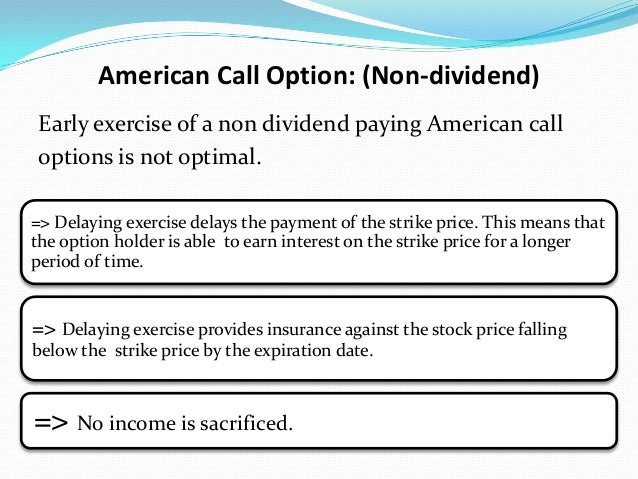

Put-Call Parity for American-Style Options. Under the assumption of no dividends, the original put-call parity relation for American-style options can be given by the following chain of inequalities: Instead of one simple equation for Eu ropean-style options, the put-call parity relation for American-style options is a chain of inequalities, where the difference between the upper and lower bounds, i. For a reasonable exercise price, risk-free rate. About About Scribd Press Our blog Join our team!

Contact Us Join today Invite Friends Gifts. Legal Terms Privacy Copyright. Sign up to vote on this title. You're Reading a Free Preview Download. Close Dialog Are you sure? Also remove everything in this list from your library. Are you sure you want to delete this list? Remove them from Saved? Join the membership for readers Get monthly access to books, audiobooks, documents, and more Read Free for 30 Days. Discover new books Read everywhere Build your digital reading lists.

Close Dialog Get the full title to continue.